News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

IMF will

implement new SDR "reserve currency"

that was created in 1978-79 but went undercover

in 1981 when Reagan became President.

Had

Ronald Wilson Reagan not been elected the 40th President of the

United States on Nov. 4, 1980, and had James Earl Carter been reelected

instead, by the summer of 1981 the newspapers would not have been focused

on Reagan recuperating from a near-fatal assassination attempt

at the hands of wannabe assassin John Hinckley, but rather the

media would be asking when would Americans start using the global currency

of the International Monetary Fund instead of the US dollar?

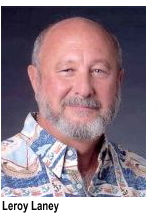

In

April, 1980 economist Leroy O. Laney, then an Assistant Professor

of Economics at the University of Miami and now Professor

of Economics at the University of Hawaii, was quietly

retained as an economist-consultant for the Federal Reserve Bank

in Dallas to examine the weakness of the foreign exchange value of the

US dollar and estimate the viability of the dollar's future as the world's

reserve currency. In the first page of his report, after carefully noting

his report was a "working paper," and not a planned action of

the Fed, he observed that questions about "...the dollar's continued

role at the center of the world's financial system" arise when

the dollar comes under downward pressure in the market. Laney noted

the current pressures began in 1973 when the dollar fell after being devalued

twice in one decade, between 1973 and 1978.

In

April, 1980 economist Leroy O. Laney, then an Assistant Professor

of Economics at the University of Miami and now Professor

of Economics at the University of Hawaii, was quietly

retained as an economist-consultant for the Federal Reserve Bank

in Dallas to examine the weakness of the foreign exchange value of the

US dollar and estimate the viability of the dollar's future as the world's

reserve currency. In the first page of his report, after carefully noting

his report was a "working paper," and not a planned action of

the Fed, he observed that questions about "...the dollar's continued

role at the center of the world's financial system" arise when

the dollar comes under downward pressure in the market. Laney noted

the current pressures began in 1973 when the dollar fell after being devalued

twice in one decade, between 1973 and 1978.  Clamoring

to replace the dollar as the world's reserve currency in 1980 was the

Duetschemark, the Swiss Franc and the Japanese Yen. Today, it's the Russian

Rouble and the Chinese Yuan. The Deutsche Bundesbank argued,

in 1979, that the Deutschemark should become the world's reserve

currency since, in 1979, the mark accounted for 11.3% of the official

foreign exchange, making it the most likely replacement for the US dollar.

Clamoring

to replace the dollar as the world's reserve currency in 1980 was the

Duetschemark, the Swiss Franc and the Japanese Yen. Today, it's the Russian

Rouble and the Chinese Yuan. The Deutsche Bundesbank argued,

in 1979, that the Deutschemark should become the world's reserve

currency since, in 1979, the mark accounted for 11.3% of the official

foreign exchange, making it the most likely replacement for the US dollar.

In the 1970s, due to the volatility of the US dollar and the weakness of the British pound, there was a lot of talk about reviving the official monetary role of gold—but not necessarily reinstituting the gold standard. Gold advocates suggested using gold as an alternative asset in central bank portfolios. The Carter Administration assured the European Community in 1978 that if the Europeans sought reserve currency diversification for both their national markets and the euromarkets, the United States would not attempt to artificially perpetuate the international status of the US dollar. By 1980, Carter further obliged the globalists in Europe who were attempting to create a global monetary unit to replace all of the world's currencies by amassing its own foreign currency reserve rather than relying on short-term central bank swap lines and the traditional financing of the nation's deficit by increasing dollar-denominated liabilities to foreign countries.

Against

that backdrop, according to Laney, the Carter Administration

very quietly began urgent discussions about implementing a much larger

role for the International Monetary Fund as the world's

primary "storehouse " of international liquidity. As the shift

in the bulk of the gold reserves in the world from the United States to

Europe occurred from 1932 to 1960, the governments of Europe expressed

growing apprehension about whether or not there was adequate liquidity

in the gold exchange standard. Floating exchange rates, initiated in 1974,

rendered that argument mute.

Against

that backdrop, according to Laney, the Carter Administration

very quietly began urgent discussions about implementing a much larger

role for the International Monetary Fund as the world's

primary "storehouse " of international liquidity. As the shift

in the bulk of the gold reserves in the world from the United States to

Europe occurred from 1932 to 1960, the governments of Europe expressed

growing apprehension about whether or not there was adequate liquidity

in the gold exchange standard. Floating exchange rates, initiated in 1974,

rendered that argument mute.

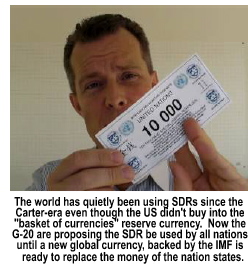

The SDR, which was put on the back burner in the United States nevertheless became a needed financial instrument in what was then evolving into the European Economic Community [EEC]. Europe still wanted the SDR to replace the dollar as the world's reserve currency). The SDR was a basket of 16 of the industrial world's most viable currencies Structurally, one SDR was equal to one US dollar which was, at that time, still loosely tied to the $34 oz. price of gold. The financial weight of the currencies in the "basket" were determined by each country's share of world exports from 1968 to 1972. The first major modification of the "basket" occurred with OPEC's leverage of the global oil markets. In July, 1978 the Saudi Riyal and the Iranian Rial replaced the Danish Krone and the South African Rand. Under IMF rules, the weight of the currencies in the "basket" would be reevaluated every five years, with the next adjustment due in 1983.

The argument on behalf of the SDR was that holding international reserves in SDRs posed less of a valuation risk on the reserves than if a country was holding a single reserve currency—like the US dollar. Most people believed that the SDR currency died with Carter's aspirations for a second term. Because globalism is not popular in the United States, the SDR simply went underground with the US media never mentioning its existence after President Ronald Reagan found a vault full of SDRs when he assumed the White House. Reagan disposed of them.

On Thursday, April 2, 2009 Foreign Policy magazine, the periodical of the Council on Foreign Relations, reported that because the United States, Britain and China "cold-shouldered most of Europe," they were forced to implement what they called "toothy regulatory measures" that places the burden on the IMF to become the "first responder" in global financial crisis.

It is important to understand the ramifications of what transpired in London. While the national media in the United States reported that Resident Barack Obama's visit to the G-20 was a success, it was successful only if you think Jimmy Carter's stint in the White House was a success. Obama, who envisioned his trip to the G-20 as the reincarnation of FDR's dominance over Europe's leaders actually rebirthed the inefficaciousness of Carter. The community activist is simply not up to the task of leading a nation let alone believably affirming his role as the leader of the free world.

As the mainstream media trumpeted Obama's successes with the Russians at the conference, namely a summit in Moscow in July where an Obama-era SALT Treaty will replace a Carter-era SALT Treaty, the Russians took a hard jab at Obama on Thursday by suggesting the SDR basket of regional currencies must replace the US dollar as the world's reserve currency. Russian President Dimity Medvedev was less than diplomatic when he said that the countries most responsible for the problems in the world market—the United States, China and England—should be shouldering the responsibility for their macroeconomics policies, but they failed to curb the excesses of their economic diplomacy. He then proposed a new currency reserve, the SDR basket of currencies, partially backed by gold to restore integrity to the world's reserve currency. Medvedev actually wanted to promote the rouble as the world's reserve currency, but the G-20 was not going to exchange the dollar for the rouble—or the yuan.

When the G-20 voted to approve the SDF as the world's reserve currency, it actually voted to accept as currency the fiat of an invisible world empery without a physical land mass of which it is sovereign. The "nation" without national lands fills the no-man's land between nations and claims the voids of the deep as its domain. Now that "nation" has its own currency. Without a citizenry that owes it allegiance, all it lacks is the right to impose its wills on the human chattel of all of the nation states of the world. That, too, will come. Quickly, probably, since the man who claims to be the leader of the free world has no spine.

Medvedev, on behalf of the money barons, told the G-20 attendees that "...[I]t is not our goal to destroy existing institutions or to weaken the dollar, pound or euro. We are simply calling for a joint assessment of how the global currency system can most favorably be developed for the sake of the global economy." Then, before Obama realized he had been spiked in the back, Medvedev called for the G-20 to form working groups to draft two studies. One study will examine the best means to widen the currency basket to include other national currencies in order to make the emerging economies feel like participants of the global economy. The second focused on creating a new global currency to replace all of the national currencies in the world. Expect this to be ramrodded through the super majority Democratic Congress before the US national election in 2012. If it appears to the Democratic leadership that they will likely lose their super majority, be prepared for Senate Majority Leader Harry Reid and House Speaker Nancy Pelosi to try to ram it through Congress before the midterm elections on Nov. 2, 2010.

In the closing round of talks at the G-20 in London, the world's 20 largest economies empowered the IMF, like the US Federal Reserve—to create money from nothing—and to begin what they called "quantitative financial easing" by putting a global currency in play. It is outside the control of any sovereign state to stop it. When the London Daily Telegraph reported that, columnist Ambrose Evans-Pritchard noted that "Conspiracy theorists will love it." Alex Jones' Infowars.net was among the first to report that the "London Telegraph Admits Plan for Bank of the World, Global Currency." And, Jones correctly summed it up when he quoted Pritchard: "The world is a step closer to a global currency, back by a global central bank, running monetary policy for all humanity."

Conservative America is now certain that a non-vetted, non-US citizen unconstitutionally occupies the White House. If they can add 2 + 2 and come up with "four," they should be able to figure out how someone born in Kenya and whose claims to natural birth as an American was exchanged for Indonesian citizenship by Obama's stepfather, Lolo Soetoro, could escape vetting as millions of US voters are demanding that vetting take place. Who has enough political power to ignore the voters? Two plus two, in this case, equals big money. The money barons, who have manipulated the winners and losers in every presidential race since 1912 (with the single exceptions of 1964 and 1980), needed a man completely devoid of any sense of patriotic loyalty to the United States of America in the White House since he will be expected to surrender the sovereignty of this nation to the invisible empery of the New World Order before he leaves office on Jan. 20, 2013, or through impeachment in 2011.

While the globalists in the G-20 want us to think so, the US economy is not in peril. It is in trouble, but only because of actions deliberately taken by the Fed, Congress and the Obama White House to create the problems we face so that we will believe the drastic measures they propose are the only solution to the economic peril they insist exists.

What is in peril at this moment are the jobs of every Congressman and Senator who stuck their hands too deeply into the pockets of the taxpayers to fix a problem that was deliberately promulgated by the Federal Reserve to create a global crisis. (The Fed was using the playbooks of Thomas Woodrow Wilson from 1913 to create the Fed and from Franklin Delano Roosevelt to create the 4th branch of government that does not answer to the voters.) Now the money barons will use this unconstitutional authority they have assumed to erase our national borders and merge the United States into a socialist global community where the majority views of totalitarian nation states will frame the laws by which the newly enslaved United States will be governed.

In 2007 as the subprime mortgage industry began to wobble, the Fed implemented a rule known as "mark to market." Mark-to-market means the mortgages being held as collateral for the debt loaned to home buyers must be reduced in value if those mortgages are in troubled markets—even if the mortagee's payments are current and the home owners have never been late. When the subprime mortgage market collapsed in early 2008, the Bush-43 White House began proposing a plan for the Resolution Trust Company to buy up the subprime mortgages, get them out of the inventories of the commercial banks and free up money for consumer credit. Had they done so, there would have been no financial crisis, and the $700 billion Emergency Economic Stabilization Act of 2008 would have been more than enough to end the nation's "financial crisis."

When banks are forced to reduce the value of the assets they are holding as collateral on loans, it radically alters their Fed-mandated asset-to-debt ratios and reduces or eliminates the availability of money they can loan to consumers. By twice ignoring the will of the people and not removing the defaulted subprime mortgages either through the Emergency Economic Stabilization Act of 2008 or Barney Frank's Housing and Economic Recovery Act of 2008, both Treasury Secretary Henry Paulson (Bush-43) and Timothy Geithner (Obama)—who were given distribution authority by the far left Congress—let recipient banks use the stimulus money that was supposed to free-up Compounding the problem, the far left Congress led by Obama promulgated the biggest taxpayer heist in the history of the world with Public Law 111-016, the American Recovery and Reinvestment Act of 2009. Politicians reached into the pockets of generations of Americans not yet born and snatched yet another $789 billion.

Even more than bailing out the richest money barons in America, the taxpayers of the United States discovered that Congress also allowed the banks to use stimulus dollars to bolster their investments in foreign markets thereby forcing US taxpayer to jumpstart the stalled economic growth of the emerging nations of the New World Order.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.