News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles

(2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

Tax

protesting New Hampshire couple found guilty.

Ed and Elaine Brown will be sentenced in April, 2007.

There is not

much that sets 62-year old Plainfield, New Hampshire retired exterminator

Edward L. Brown apart from any other tax protester (they preferred

to be called members of the "Tax Honesty Movement") who

was just found guilty on federal income tax charges—except that he's

a US Constitution Ranger (a member of a group of self-styled Constitution

"experts" with no legal expertise on constitutional law) and

his wife, Dr. Elaine Brown, DDS, is—or was—a successful

dentist. Ed Brown is also the spokesman for the Constitution

Defense Militia. He also claims membership in the Continental Congress

of 1777, the UnAmerican Activities Investigation Commission—an

ad hoc group he founded—and several other militia and/or anti-tax

groups. He and his wife are probably on their way to a federal lockup.

When

the jury found them guilty, the judge unsealed the bench warrant calling

for the custodial arrest of the Browns that was actually issued—and

sealed—on the fourth day of the trial in January, 2007 when Ed

Brown stopped attending in "protest" of what he called a

"rigged" trial.

When

the jury found them guilty, the judge unsealed the bench warrant calling

for the custodial arrest of the Browns that was actually issued—and

sealed—on the fourth day of the trial in January, 2007 when Ed

Brown stopped attending in "protest" of what he called a

"rigged" trial.

The bench warrant

was given to US Marshal Stephen Monier. Monier's office

said the marshals did not intend—for the moment—to go to the

Brown "compound" to arrest the former exterminator. Monier

indicated he hopes to negotiate Brown's peaceful surrender. Within

a day of the verdict, anti-tax advocate Bob Schulz from the We

The People Foundation showed up at Brown's home in Plainfield.

Schulz,

a former radio talk show host first became interested in the antitax movement

when guests on his program proved to his satisfaction that the 16th Amendment

was never legally ratified. For the past seven or eight years Schulz

has been attempting to force the government to discuss the ratification

certification in a public forum, and defend the government's position

that the implementation of 16th Amendment in 1913 was a lawful exercise

of government power.

Schulz,

a former radio talk show host first became interested in the antitax movement

when guests on his program proved to his satisfaction that the 16th Amendment

was never legally ratified. For the past seven or eight years Schulz

has been attempting to force the government to discuss the ratification

certification in a public forum, and defend the government's position

that the implementation of 16th Amendment in 1913 was a lawful exercise

of government power.

Brown

made it clear to his friends and to the media that he was not going to

prison. About two dozen of Brown's supporters have joined him in

his wooded cement-walled house. One of his friends, Bernard Bastian—who

told the media he came to the Brown's home with two guns—said

they would fight to avoid capture.  Speaking

of Brown, he said "...he's here at the house—and he's

not leaving of his own free will." Brown heard the verdict

while he was doing a radio talk show. "The verdict is in,"

he told the talk show host on WNTK-FM in New London, Connecticut. "I

can guarantee you all Hell's going to break loose," adding that

he was convicted on "...bogus charges. None of the charges are

lawful." In point of fact, Brown was wrong. The charges—at

least most of them—were lawful. One is questionable and, if properly

challenged during the trial, should have resulted in a "not guilty"

verdict on that one specific allegation. The charge was conspiracy to

structure financial transactions.

Speaking

of Brown, he said "...he's here at the house—and he's

not leaving of his own free will." Brown heard the verdict

while he was doing a radio talk show. "The verdict is in,"

he told the talk show host on WNTK-FM in New London, Connecticut. "I

can guarantee you all Hell's going to break loose," adding that

he was convicted on "...bogus charges. None of the charges are

lawful." In point of fact, Brown was wrong. The charges—at

least most of them—were lawful. One is questionable and, if properly

challenged during the trial, should have resulted in a "not guilty"

verdict on that one specific allegation. The charge was conspiracy to

structure financial transactions.

The jury found each of the Browns guilty on one count of conspiracy to defraud the federal government and one count of conspiracy to structure financial transactions, five counts of federal income tax evasion and eight counts of failing to collect federal payroll taxes for employees in her Lebanon, New Hampshire dental offices. The Browns face 5-years in prison on each count for which they were convicted (except the structuring charges which carry a maximum penalty of 10-years. Both could be sentenced up to 80-years. In addition, each conviction carries a fine of up to $250 thousand. The judge could impose a fine of up to $4,250,000.00. All of their assets—in particular their wooded, 110-acre, cement reinforced home which Brown converted into a fortress with a military-style watch tower over the last ten years—will likely be seized by the government. In addition to the fines, the jury ordered the Browns to forfeit $215 thousand.

Brown told cybermedia reporters that he was convinced all along he would not get a fair trial in US District Court because "...among other reasons, the federal court and [my] accuser are the same entity. We're working on legal matters and actions," he told TinyURL.com in a telephone interview. Brown said he filed more than 40 motions in the case. All of them were dismissed without a hearing. "We used motions in their court," he said. "We should have used affidavits because the judge has to respond lawfully to affidavits. That's where we made our mistake. But that's okay. There's still room. We're going to be working on something pretty soon to nullify the whole problem. This court," he said, "is totally off the wall for its actions, and the record will show that clearly. The jury was rigged." Brown added that his plight has sparked interest from legal analysts across the country who are "...stunned that the judge had the audacity to just dismiss everything offhand. He violated so many due processes it's incredible."

US District Court Judge Steven L. McAuliffe (appointed by President George H.W. Bush on Sept. 9, 1992) dismissed Brown's "motions' as frivolous because they were not based on case law. They were pseudo-legal arguments based on Brown's personal opinion that [a] the 16th Amendment was not legally ratified, [b] there are no federal laws that compel him specifically to pay taxes, and [c] the federal government has no jurisdiction in New Hampshire. Sadly for Brown's case, the retired exterminator-turned-tax-protester was unable to find a single elected New Hampshire official who would affirm that in federal court. IRS Special Agent Douglas Bricker told the Associated Press that the Brown verdict "...clearly reaffirms the repeated rejection of those arguments in the courts." Bricker prefaced his remarks to the press by admitting that "...[s]ome people are drawn to the anti-tax movement, and [have bought into the argument] that there is no legal requirement to file and pay taxes."

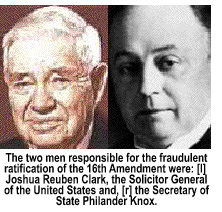

Edward

and Elaine Brown are very likely going to spend the rest of their

lives in a federal prison because they bought into a myth. The myth? That

American citizens are not required to pay income taxes. There are scores

of anti-tax advocacy groups selling "educational courses" to

unwary taxpayers that advance as fact their theories. Many of those who

sell education packets designed to convince taxpayers they do not have

an obligation to pay taxes to the federal government pay taxes.  Here

is the truth about the federal income tax. The 16th Amendment was

needed to constitutionally levy a federal tax on incomes. (The States

have always had the right to levy an income tax.) The 16th Amendment was

fraudulently declared ratified by Secretary of States Philander Knox

and Solicitor General Joshua Reuben Clark on Feb. 3, 1913. (Without

going into all of the irregularities which invalidate most of the ratification

resolutions from the States, the 36th State [the one needed to gain an

affirmative vote from three-fourths of the States if you ignore all other

errors in the certifications to theoretically ratify the 16th Amendment]

was West Virginia. West Virginia did not even vote on the amendment until

asked to do so by Woodrow Wilson's Secretary of State William

Jennings Bryan, as a "vote for unity." (In reality, Bryan

inherited a mess that would not survive a court challenge and he knew

it.) West Virginia voted to approve the 16th Amendment on April 13, 1913—50

days after Knox declared that West Virginia pushed the 16th Amendment

over the limit. So, any way you look at it, a perpetual grey cloud hangs

not only over not only the 16th Amendment but the 17th Amendment as well.

Here

is the truth about the federal income tax. The 16th Amendment was

needed to constitutionally levy a federal tax on incomes. (The States

have always had the right to levy an income tax.) The 16th Amendment was

fraudulently declared ratified by Secretary of States Philander Knox

and Solicitor General Joshua Reuben Clark on Feb. 3, 1913. (Without

going into all of the irregularities which invalidate most of the ratification

resolutions from the States, the 36th State [the one needed to gain an

affirmative vote from three-fourths of the States if you ignore all other

errors in the certifications to theoretically ratify the 16th Amendment]

was West Virginia. West Virginia did not even vote on the amendment until

asked to do so by Woodrow Wilson's Secretary of State William

Jennings Bryan, as a "vote for unity." (In reality, Bryan

inherited a mess that would not survive a court challenge and he knew

it.) West Virginia voted to approve the 16th Amendment on April 13, 1913—50

days after Knox declared that West Virginia pushed the 16th Amendment

over the limit. So, any way you look at it, a perpetual grey cloud hangs

not only over not only the 16th Amendment but the 17th Amendment as well.

For that reason alone the US Supreme Court should have addressed the issue and ruled on whether or not the 16th Amendment was legally ratified when the issue popped up for the first time in 1983 during the income evasion trial of Allen Lee Bucta. Since 1913, over a hundred thousand pages of codified regulations (federal laws) exist in the tax code that require everyone—American citizens or non-citizens—who earns an income in this country to [a] file an income tax form annually and [b] pay taxes on those earnings. There are no loopholes to slip through regardless what the anti-tax expert you paid claims—or from what 7-Eleven he or she got their law degree. Every business in the United States (since World War II) has been required by federal law to use payroll deduction to collect federal taxes (and, by State law, all State taxes). The business owner is then required by law to submit those tax payments to the government on behalf of the employee.

Even with the legality of the 16th Amendment up in the air, the income tax is the law of the land. It's legal—and its enforceable. If you don't pay, the least that will happen to you is having all your assets seized. The worst that will happen is that all your assets will be seized and you will go to prison from 7 to 50 years. When you look at the tax protesters you know that have not yet been confronted by the IRS, just remember...the tax man cometh. Always. The IRS is just waiting until your friend or acquaintance has dug the tax hole deep enough to swallow not only him but everything he owns. Uncle Sam likes memorial examples. If all the tax protester got was a slap on the wrist. or a small fine, there would probably be more tax protesters.

In conclusion...Uncle Sam will always create as many charges as they can when they haul tax protesters to court. In the case of Dr. Elaine Brown (who was the primary, if not the only, wage earner), it appears the Browns adapted a strategy to keep their assets liquid and conceal their income. By dealing only in cash they believed they could avoid creating an auditable income trail. Nevertheless, the IRS estimated that Dr. Brown's dental practice earned approximately $1.9 million between 1996 and 2003 for which no 1040s were filed.

The conspiracy to structure financial transactions charge stemmed from the Browns using postal money orders instead of bank checks to pay their mortgage each month. The government charged that the Browns deliberately intended to stay under the $3,000 "Know Your Customer" transaction bank reporting threshold by purchasing four $700 US Postal Money Orders to pay their mortgage each month. (The Browns' monthly mortgage payment was apparently around $2,800.) The IRS appears to have failed to note to the court that the maximum amount for which a postal money order can be drawn is $700. The IRS produced postal money order receipts to show that the Browns had paid their mortgage company $215,890 with 311 postal money orders during the period when they paid no taxes, suggesting that the use of the money orders in the amounts drawn supported the government's argument that the Browns were trying to stay under the bank reporting radar screen, thus perpetuating a fraud.

That's the only real scary part of the Brown's tax scenario. Granted, what the Browns are going through is scary. But, it had to be expected. The Browns are guilty of income tax evasion. Sad as their plight is, they brought that problem to their own doorstep over a decade ago when they bought the rhetoric of whatever glib-tongued anti-tax, swamp oil salesman convinced them that there are no federal laws that require American citizens to pay Woodrow Wilson's income tax. Notwithstanding the fact that the 16th Amendment was fraudulently declared ratified by Secretary of State Knox, the federal income tax is the law of the land until Congress or the federal courts vacates the statutes that require taxpayers to file and pay once a year.

On more than one occasion, the federal court system has acknowledged Knox's fraud but has made it clear to the defense attorneys who enter their courts armed only with proof of the 16th Amendment fraud that until Congress addresses it, the federal income tax remains a valid exercise of government power. It would seem to me that our job, as the citizen caretakers of liberty, is to make sure that Congress addresses this issue—sooner rather than later. Unfortunately for the American taxpayer, once fraud is uncovered, those defrauded—in this case the American people—have seven years to bring an action against the government. Those who discovered the fraud—M.J. "Red" Beckman, William Benson and George Sitka—did not petition the US Supreme Court to invalidate the 16th and 17th Amendment before the statute of limitations expired in 1991.

When the Clinton Administration, aided by the GOP controlled Congress enacted the Bank Secrecy Act of 1998, there were apparently a few secrets in the legislation that Uncle Sam and the "conservatives" on the Hill didn't want the public to know about. The argument of the Clinton Administration and the legislation's defenders on the Hill was that the purpose of the Bank Secrecy Act was to require financial institutions to report suspicious activity involving monetary transactions passing through 10,483 commercial banks and savings institutions that are members of the Federal Reserve System and 5,863 State-chartered banks that are not members but whose deposits are insured by the Federal Deposit Insurance Corporation [FDIC]. When the USA Patriot Act was rammed through Congress in October, 2001 the Bank Secrecy Act was amended, expanding the right of government to access information concerning the bank transactions of ordinary people leading ordinary lives just, it seems, to see where they spend their money—and how much money they actually spend. Does the household spend more money than their collective W-4s say they earned? If so, where did that extra money come from? Under the amended Bank Secrecy Act of 2001 gold brokers are required to notify the US Treasury when consumers purchase a total of $10 thousand in gold bullion or numismatics in any 30-day period. However, the legal argument of the IRS during the Brown trial suggests that the $10 thousand reporting threshold may have been lowered to $3 thousand, with the consumer's bank and not the gold broker, reporting the transaction.

During the reporting period on the Bank Secrecy Act of 1998, Christie Sciacca, an Associate Director of the FDIC the House Banking Committee on March 4, 1999 on the public outcry against the Big Brother characteristics of the "Know Your Customer" provisions in the law which had already been enacted. Addressing Chairman George Gekas [R-PA] and ranking Democrat, Gerrold Nadler [NY], Sciacca reminded the Committee that the integrity of the nation's banking system is rooted in confidence. She added that it was never the FDIC's intention to upset the balance with the consumer since confidence in the banking system is what allows it to attract and maintain honest customers. She then noted that by that date, over 135,000 complaints from the public had been received over the Big Brother aspects of the law which, she noted, was implemented to uncover illegal activities such as money laundering for drug dealers and other criminal ventures as well as transporting funds to terrorist organizations. Sciacca noted that because of the complaints—now totaling well over a quarter million—"...it is obvious to [the FDIC] that the [Know Your Customer] proposal cannot become final in its current form—if at all."

On October 26, 2002 "Know Your Customer" became mandatory at every bank, savings and loan, credit union, and establishment selling money orders or other forms of alternative money, in the nation. Big Brother is now officially checking what you spend—and where you spend it. It's no wonder the size of government is still growing. It does make me wonder who's watching the people who are watching us? When you trust no one, there's no one left you can trust.

Once again you have my two cents worth.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.