News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet

Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

The

man who collapsed IndyMac

In May,

1907 investment banker John Pierpont Morgan deliberately leaked

inaccurate information to the New York Times that the Knickerbocker

Bank in New York was insolvent. Although Morgan's name was

not linked to the New York Times story, even before the paper hit

the street, the source of the rumors was on everyone's lips. The bank's

depositors became frightened because they believed Morgan, the

best known banker of the day, was probably right. This triggered a run

on the Knickerbocker Bank that ultimately proved the rumor was

right—Knickerbockers Bank ran out of money and had to shut their

doors. The bank panic spilled over to other banks, first in New York,

then all over the country.

The media sleuths of the early 20th century were quick to identify the culprit who started the rumor but it would be six years before they understood the reason. The Bank Panic of 1907 was deliberate. The purpose was to manufacture a crisis that would allow the bankers to createa permanent central bank in the United States to solve the "problem" of unstable banks. The bank panic, the passage of the 16th Amendment and the legislation known as the Federal Reserve Act of 1913 (signed into law by Thomas Woodrow Wilson on Dec. 23, 1913), were all triggered by the actions of one man: J.P. Morgan.

Today,

the world's bankers face a new problem: how

do you merge 182 currencies into four or five, and then, how do you

collapse them into one—when none of the citizens of any of the 182

nations want their currencies merged into one? You do what they did in

1907. You create a panic, or a series of panics over three or four years

that suggest the banking system is irreparably broken. Each panic will

cost thousands of US citizens millions of dollars, or over three or four

years, it will cost millions of US citizens billions of dollars.

Today,

the world's bankers face a new problem: how

do you merge 182 currencies into four or five, and then, how do you

collapse them into one—when none of the citizens of any of the 182

nations want their currencies merged into one? You do what they did in

1907. You create a panic, or a series of panics over three or four years

that suggest the banking system is irreparably broken. Each panic will

cost thousands of US citizens millions of dollars, or over three or four

years, it will cost millions of US citizens billions of dollars.

Remember the Crash of 1929? (Few of us actually remember it first hand, since that would make us 80 to 90 years of age.) The Crash of 1929, like the Bank Panic of 1907, was a carefully staged dichotomy orchestrated by the nation's most power investment bankers, led—once again—by JP Morgan & Company. This time what was at stake was removing the United States from the gold standard and creating an elastic dollar that would give the Fed complete control over the fate of the economy of the United States—for the enrichment of the bankers. The bankers did not get the constitutional amendment they sought to remove the United States from the gold standard (and have not to this date). But the Congressional Gold Repeal Joint Resolution of June 5, 1933 did the same thing: it detached gold from the valuation of money. On Feb. 18, 1935, in a 5-to-4 decision, the US Supreme Court ruled in favor of the New Dealers. (Revisionist historians have argued that the widespread adoption of the bimetallic monetary system is a recent event dating back only to the mid-19th century, brought about by the industrial revolution. Apparently none of those "historians" have ever read the Constitution.)

The

motive for Sen. Chuck Schumer [D-NY] to trigger what he had to

know would start a run on IndyMac Bank is unclear. Schumer-watchers,

who refer to the Senator as "Crazy Chucky," said Schumer's

motive was to create headlines where he played a dominant role in warning

the American people of the pitfalls of the free enterprise system.

Schumer is not a stupid man even though his actions on June 26 (which

led to the run on IndyMac and the seizure of the bank's assets on July

12) nevertheless suggests he's not the brightest bulb in New York.

The

motive for Sen. Chuck Schumer [D-NY] to trigger what he had to

know would start a run on IndyMac Bank is unclear. Schumer-watchers,

who refer to the Senator as "Crazy Chucky," said Schumer's

motive was to create headlines where he played a dominant role in warning

the American people of the pitfalls of the free enterprise system.

Schumer is not a stupid man even though his actions on June 26 (which

led to the run on IndyMac and the seizure of the bank's assets on July

12) nevertheless suggests he's not the brightest bulb in New York.

Schumer, a member of the Senate Banking Committee, chairman of the House & Senate Joint Economic Conference and the third-ranking Democrat in the Senate, sent letters to the Office of Thrift Supervision, the Federal Deposit Insurance Corporation and the Federal Home Loan Bank of San Francisco saying he was "...concerned that IndyMac's financial deterioration posed significant risks to both taxpayers and borrowers...[and that, IndyMac, which had suffered massive losses on defaulted subprime mortgage loans]...could face a failure if prescriptive measures [were] not taken quickly." Since the Senate Banking Committee provides oversight to the Office of Thrift Supervision, the FDIC and the Home Loan Board, pointing fingers is a congressional prerogative. However, screaming "fire!" in a movie theater is not. And that is precisely what Schumer did.

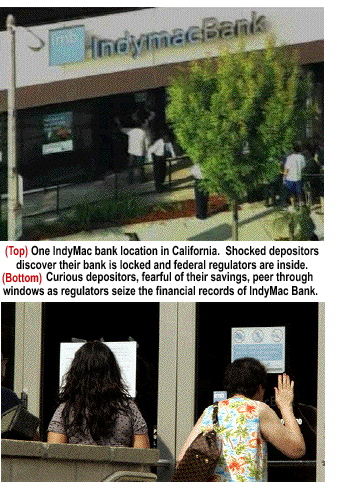

When Schumer's remarks appeared in several newspapers it triggered a run on IndyMac Bank that resulted in depositors siphoning off $1.3 billion in personal deposits from the bank. IndyMac Bank of Pasadena, California is the 5th FDIC-insured bank failure this year and the second largest bank failure in US history. Citing a massive run on deposits as the reason for the takeover by banking regulators, the OTS stepped in and shutdown the main IndyMac branch 3-hours early on July 12. IndyMac Bank has 33 branches which closed over the weekend and reopened on July 14.

Bank regulators noted that the takeover of IndyMac, which has assets of $32.01 billion and deposits totaling $19.06 billion at the end of its first quarter this year, will cost taxpayers between $4 billion to $8 billion. In a statement to the media on July 12, OTS Director John Reich said: "This institution failed today due to a liquidity crisis. Although this institution was already in distress, I am troubled by any interference in the regulatory process." Reich continued by saying: "The immediate cause of the closing was a deposit run that began and continued after the public release of a June 26 letter to the OTS and the FDIC from Sen. Charles Schumer of New York."

Irritated that Reich had the audacity to blame him for the run—which he actually did cause—Schumer used the Sunday talk shows to blame the Bush Administration for "...blaming the fire on the person who calls 911." Schumer denied that his June 26 letter caused one of the costliest bank failures in US history. Defending himself, Schumer said: "IndyMac was one of the most poorly run and reckless of all the banks..." adding that "...the breadth and depth of the problems at IndyMac were apparent for years, and they accelerated in the last six months...If OTS had done its job as regulator and not let IndyMac's poor and loose lending practices continue, we wouldn't be where we are today...instead of pointing false fingers of blame, OTS should start doing its job to prevent future IndyMacs."

Several commercial banks—including the nation's largest banks—as well as Fannie Mae and Freddie Mac have taken a major hit on foreclosed subprime mortgages. Was it, or is it yet, Schumer's intent to single out every bank with major subprime write-offs as banks "...which suffered massive losses on defaulted subprime mortgage loans, which could face a failure if prescriptive measures are not taken quickly?" Doing so will trigger a 1907 bank panic at a time when fiscal sanity is needed. If that is Schumer's intent, the American people need to know why.

The United States is in a financial meltdown. We are experiencing a real financial crisis created by bankers, economists, industrialists and merchant princes who, to promulgate the myth that regionalizing wealth hemispherically by transferring US jobs to the third world was not having a negative impact on the US economy when, in fact, it is having a devastating affect. Our economy is as fragile as eggshells, and any negative economic news threatens to crack that shell. Blue chip stocks have declined in value by 21.2% over the over past year. The US dollar is down 13.2% against the Euro over the past year. Mortgage foreclosures are up 53% over the past year, and wholesale prices are also up, 9.2% since June of last year.

Looking for a scapegoat to prove that the failure of IndyMac Bank was not the fault of politicians and the globalist-driven media that helped perpetuate the myth that the US economy was healthy as industrialists continue to ship 15,000 jobs a month to the third world, the FBI was sent to IndyMac to determine if the bank had engaged in fraud when it made home loans to high risk (subprime) borrowers. The FBI is currently investigating 21 companies in the subprime lending industry for possible fraud in using false information to secure mortgages for subprime borrowers.

The frantic search for a scapegoat, however, is going to have a negative impact on the economy in general and the mortgage banking industry in particular. Somber statements and predictions are coming from both ends of Pennsylvania Avenue because both the legislative and executive minds clearly understand this isn't an ordinary, run-of-the-mill economic crisis we are facing. The politicians and bankers are discovering, as this crisis unfolds, that there is a price to be paid for creating artificial, debt-fueled economic growth when the nation lacks a sufficient number of consumer-taxpayers to support the expansion of debt, and to repay the loans that were used to fabricate a concrete foundation under what can only be described as a house-of-cards.

Because the banking industry is rickety and gas prices have drained the pockets of America as commodity prices continue to soar, the US economy has slowed to a virtual crawl. Kenneth Rogoff, the former chief economist for the International Monetary Fund, notes the banking crisis is going to trigger a recession. Several economists have noted that during the fabricated housing boom banking regulators stood, blindly, off on the sidelines, convinced the job growth and flow of discretionary money would stimulate the economy and cure the negative impact of the two decades-long jobs drain. "It seemed too good to be true," Rogoff observed. "And, it was...Today is payback....There 's no hope of an early recovery at this point. The best case scenario we have is we a long, but mild, recession—and that's a best case scenario."

Schumer is now attempting to deflect the blame for government's seizure of IndyMac Bank. His aide, Brian Fallon, offered an explanation after OTS Director Reich chastised Schumer by saying: "As a regulator of insured depository institutions, we do not publicly comment on the financial conditions or supervisory activities related to open and operating institutions. We believe it is critically important to maintain the confidentiality of examination and supervision information. Dissemination of incomplete or erroneous information can erode public confidence, mislead depositors and investigators, and cause unintended consequences, including depositor runs and panic stock trades. Rumors and innuendo cause damage to financial institutions that might not occur otherwise and those concerns drive our strict policy of privacy."

Following the Reich statement, former US Comptroller of the Currency John D. Hawke added his own unofficial views. "Leaking his IndyMac letter to the press was reckless and grossly irresponsible," he said. "I don't see how he can be trusted with confidential information in the future." (In reality, Democrats have a sordid history of leaking confidential and sometimes highly classified information to the press solely for political gain.) "What this incredibly stupid conduct does is put at risk the willingness of regulators to share any information with the oversight committees [in Congress]. After this, you'd be crazy to share information with Schumer...If Schumer continues to go public with letters raising questions about the condition of individual institutions, he will cause havoc on the banking system." And, of course, in an election year with an unpopular member of the opposition in the White House, nothing generates votes for your party like a really good recession.

Schumer's defense, reiterated by Fallon, was that "...[t]he home loan bank system has an obligation to lend responsibly and police its members. But it has not been doing its job. We have found the only way to get the home loan bank system to act appropriately and positively is to make public the concerns we've already expressed privately." Schumer also leveled his own accusations in the form of a weak explanation. "Now they're doing what the Bush Administration always does—blame the fire on the person who calls 911." In reality, as previously noted, what Schumer did was yell "fire" in the movie theater.

Since Schumer does not come up for reelection until 2010 its hard to understand his motives for making unfounded allegations about IndyMac. Schumer suggested that the bank was unsound when, before the run specifically caused by Schumer, it was not. It had eaten some bad loans like every bank in the country that financed any subprime business.

Is Schumer playing the JP Morgan role in the Bank Panic of 1907? Is this the opening salvo fired by globalists who are trying to create a crisis big enough to collapse the currency of the United States? This would allow Canada and Mexico "save" the US economy by formally creating a merged monetary unit called the Amero. While there are many plausible explanations, that is one that certainly makes sense.

Well, once again, you have my two cents worth on Mr. Schumer.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.