News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

By

Jon Christian Ryter

Copyright 2001 - All Rights Reserved

To distribute this article, please post this web address or hyperlink

![]() ven

though the stock markets of the United States, Europe and Asia have

been trying hard to begin a much-needed corrective nosedive for close

to two years—some 12 to 15 months before last year’s presidential

election campaign cauldron ever reached its midsummer 2000 political

boiling point—the Democrats in the United States were doing everything

they could to convince the American people that the economy was still

healthy and robust even though thousands of Americans had watched their

jobs—and, more times than not, the entire industries where they

earned their living (precluding their chances of getting another job

in the same environment) head north to Canada or south to Mexico due

to NAFTA. The economic rhetoric that constantly flowed from the Gore

Camp during the last presidential campaign was that America was enjoying

the longest period of sustained economic growth in the history of the

world thanks to Bill Clinton and Al Gore; and that America also had

the largest revenue surplus in its history as well. As far as Al Gore

was concerned, life in America could not be better. The market was up;

the price of gold was down. Americans had more paper wealth than at

any time in our history since 1928. Not only did most Americans have

Herbert Hoover’s “chicken in every pot,” most had two

even though the GOP-controlled Congress forced Clinton and Gore to end

generational welfare in the United States in 1995 (with Bill Clinton

promising to restore it as soon as the Democrats regained control of

Congress). In fact, while they may not be the latest models, most Americans

have two cars parked in their driveway or garage plus at least two TVs

and two VCRs in the family home. And, in many cases, a good many of

those two-income middle-class families in America also have two homes—the

family home in the city and a weekend retreat at the beach or in the

woods near a bubbling brook (even if the weekend retreat was, more times

than not, a time-share).

ven

though the stock markets of the United States, Europe and Asia have

been trying hard to begin a much-needed corrective nosedive for close

to two years—some 12 to 15 months before last year’s presidential

election campaign cauldron ever reached its midsummer 2000 political

boiling point—the Democrats in the United States were doing everything

they could to convince the American people that the economy was still

healthy and robust even though thousands of Americans had watched their

jobs—and, more times than not, the entire industries where they

earned their living (precluding their chances of getting another job

in the same environment) head north to Canada or south to Mexico due

to NAFTA. The economic rhetoric that constantly flowed from the Gore

Camp during the last presidential campaign was that America was enjoying

the longest period of sustained economic growth in the history of the

world thanks to Bill Clinton and Al Gore; and that America also had

the largest revenue surplus in its history as well. As far as Al Gore

was concerned, life in America could not be better. The market was up;

the price of gold was down. Americans had more paper wealth than at

any time in our history since 1928. Not only did most Americans have

Herbert Hoover’s “chicken in every pot,” most had two

even though the GOP-controlled Congress forced Clinton and Gore to end

generational welfare in the United States in 1995 (with Bill Clinton

promising to restore it as soon as the Democrats regained control of

Congress). In fact, while they may not be the latest models, most Americans

have two cars parked in their driveway or garage plus at least two TVs

and two VCRs in the family home. And, in many cases, a good many of

those two-income middle-class families in America also have two homes—the

family home in the city and a weekend retreat at the beach or in the

woods near a bubbling brook (even if the weekend retreat was, more times

than not, a time-share).

However, to the bankers at the Federal Reserve and the central banks of Europe and Asia, the bull market that began with the trickle-down economics brought about by Reaganomics was finally gone. The bull, which left the stock market like a very clumsy bull stumbling through a china shop, has now been replaced by a very hungry bear that has been devouring individual stock portfolios like they are snack food for the past year. Yet the media has nevertheless managed to convince the American people that because America’s industries were still paying handsome dividends, the market was healthy and the “corrections” which were taking place were not only normal, but they were not indicative of a market heading south—along with America’s jobs.

In an effort to shore up confidence in the global financial system that must continue to maintain a semblance of solvency until the summer of 2006 for the globalists to achieve their worldwide regional currency consolidation objectives on schedule, the Federal Reserve and the European central banks began cutting their prime rates by slight quarter-point dribbles starting in the summer of 1999 posting the first indications that the market was in trouble even though it continued to peg record gains. Within the past year the Fed has cut the prime interest rate in the United States from 6.5% to 2.5%—nine times—since Jan. 3, 2001. While the European Central Bank was slower in starting, they beat the Fed to the 2.5% rate by a month. If this trend continues, the Fed will have to start paying corporations to borrow money from them.

While the Euro bankers

had a problem conceding points when each “point” means pure

profit for the key central bank of Europe, the Fed seemed to have no

problem doing this in 1999 when called upon by the transnationalist

industrialists to bolster the Euro.

As far as the Euro

bankers were concerned, the nosedive on the big board and on NASDAQ

was due to overvaluations—particularly with e.com stocks. It was

an American problem even though it started in Europe a year earlier.

In 1999 the Federal Reserve Bank bit the bullet in order to support

the Euro. The European Central Bank, which wanted desperately to overtake

the American dollar as assume a role of fiscal supremacy over the United

States, cut their rates reluctantly. By last summer most of the rate

cutting was being done by Alan Greenspan of the Fed. (This, of course,

drove currency investors to Brussels since they could earn a better

return on the Euro.) The European Union Central Bank clearly understood

that a weak American dollar meant a strong Euro and a more robust European

Union economy.

Warnings of a Major Correction Came True

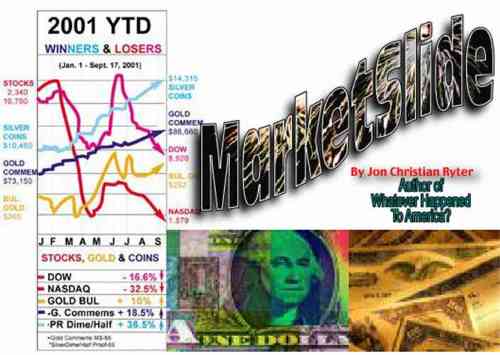

Last fall, and again earlier this year on www.jonchristianryter.com I warned the American people that the stock market was going to experience a major correction sometime this summer. I warned that another “correction” would occur on the NASDAQ that would continue the downward spiral of technology stocks, and that when America’s Fortune 1000 companies began reporting their annual “earnings” the Dow Jones would feel the brunt of America’s disappointment by the size of the dividends (i.e., the retirement earnings) being paid by the blue chips to those who had invested their pension in the market.

When I began warning the American public last Fall that if they had investment control over their company-vested 401Ks, and made all of the investment decisions over their own company-sponsored retirement programs, they needed to get at least 25% of their money out of the stock market and put it in gold. (I am the first to admit that I am not a financial consultant and have no desire to become one. I do not sell stocks, bonds, or mutual funds. Nor do I sell gold or silver coins or gold bullion. Nor am I the “shill” for any gold brokers, stock brokers, or mutual fund sales people.) If you check over my website, www.jonchristianryter.com, you will also notice that I do not accept advertising on my website. I don’t have a vested interest in what you do with your money. I point that out because when I advised the readers of my website last fall, and again this spring, to pull at least 25% of the money they had tied in the stock market and invest it either in European numismatics or bullion, I found myself the brunt of a two- or three-day verbal assault on Free Republic from well-intentioned freepers who decided I had to be a “shill” for this gold broker or that one because every time the Dow Jones nose-dived, gold remained static. It was almost as though a large, invisible hand was somehow suppressing gold—which has always been the bellwether that told the small investor when it was time to sell paper and buy precious metal or stones.

My opinions concerning the stock market are not fueled by the speculative predictions of market watchers, stock brokers or financial analysts. Nor are they fueled from my own investment “expertise,” since I am not a market expert. My forays into the market have always been brief 24- to 72-hour sojourns. In every instance I have at least doubled my money. And, no—I am not privy to “insider information.” I just don’t trust the market enough to stick around longer than one opportunity to the next—nor do I trust the bankers and industrialists who have manipulated not only the stock markets of the world but the gold markets as well. The market, for the wealthy, is a source of ongoing wealth. For the individual investing his retirement income, it’s risky business. Particularly now, at this point in history. It is the small investor, after all, who fuels the wealth of the large piranhas who gobble up a half dozen day traders every day for lunch.

When I watch the Dow slide 600 points in one day; or watch the NASDAQ lose 20% of its value in a week, I know instinctively that the price of gold has to rise. Most of the major currencies of the world—and the American dollar—is still pegged to an invisible but nevertheless real, gold benchmark—although none of the currencies of the world have been backed by gold since 1974. (None of the internal currencies of any nation in the world have been backed by gold since 1934.) Prior to the passage of the Emergency Banking Relief Act of 1933, the Agricultural Adjustment Act of 1933 (which allowed the President of the United States to arbitrarily set the spot price of gold), and the Joint Gold Clause Resolution (which unconstitutionally allowed the Roosevelt Administration to remove the dollar from the gold standard since the Constitution of the United States mandates that America’s monetary system be denominated with gold or silver).

On Sunday, March 5, 1933—the day before Franklin D. Roosevelt closed all of America’s banks—America’s one dollar certificates were redeemable on demand for a silver dollar at any bank in the nation. The silver dollar was 99% pure. At the same time, larger denomination bills were redeemable in gold coin. (The $20 bill—“goldbacks”—which pictured George Washington instead of Andrew Jackson, promised to pay the bearer, on demand, $20 in gold coin.) The $20 gold certificate pictured on the right, bears the serial number A4043114.

On March 5, 1933, those certificates were worth $20 in gold. On March 6, due to a Presidential Proclamation, gold certificates were no longer “legal tender” since [a] they were no longer backed by gold and [b] they had to be exchanged to a national bank for Federal Reserve Note of the same denomination (which was backed by nothing). On Tues., Jan. 30, 1934 Franklin D. Roosevelt signed the Gold Reserve Act of 1934. On Wednesday, Jan. 31, 1934, Roosevelt issued Presidential Proclamation 2072 reducing the weight of the gold dollar from 25 4/5 grains of fine gold to 15 5/21 grains—a reduction of 59%. The dollar, which was worth 100¢ on Jan. 30, 1934 was worth only 41¢ one day later. Americans lost 59% of their buying power within 24-hours. However, since Roosevelt froze prices in the United States and kept them frozen through World War II, most Americans didn’t realize what they had lost until 1946—and, at that time, they blamed it on the Republicans who had the misfortune of regaining control of Congress that year. However, because of the massive increases in the cost of goods in America, they gave Congress back to the Democrats in 1948—and let them keep it until 1994.

Regionalizing the currencies of the world

When the Euro was initially introduced, the European Union states were told that both the Euro and that nation’s own currency would both be used as legal tender until July 1, 2004. At midnight on June 30, 2004, the national currency of the EU nations would no longer be legal tender. Whatever British pounds, French francs or Swiss or German marks the new EU citizen had in his or her possession would become worthless at 12:00:01 a.m. on July 1, 2004. That date has since changed—twice. Now, effective February 1, 2002, the Euro will become the official currency of the European Union. Interestingly, on that same date, the American dollar will become the official western hemisphere monetary unit. On February 1, 2002 the American dollar will become the dual currency of the western hemisphere. It will become legal tender in every western hemisphere nation from Canada to Argentina. On December 1, 2002 the American dollar will replace every monetary system in the western hemisphere. At that time, the American taxpayer will assume the national debts of every nation in the western hemisphere. Not only will our children and grandchildren get to pay off the vast trillions of dollars of unpaid debt created by the House of Representatives for “use” in the United States over the past 87 years, they will get to pay off all of the debt incurred by all of the graft-riddled governments of Central and South America as well. It is important for the American taxpayer to understand that the bad loans made by the Central and South American nations over a good part of this century by American investment bankers has to be paid by someone since the bankers have no intention of losing that money. Since those debts are not being paid off “as agreed” by those nations, the American people will be forced to assume that debt. (The timeline has been advanced twice now because the transnational industrialists and global bankers are now convinced they cannot hold the stock market up much longer, nor can they artificially suppress the price of gold.

In point of fact, several South American nations have already been forced to dollarize their currencies between 1997 and 1999 by the International Monetary Fund in order to gain loans from the IMF through the World Bank. The government of Paraguay almost toppled when the IMF demanded dollarization in exchange for economic stabilization since everyone knows that whomever controls a nation’s currency controls that government.

The regionalization of the world’s currencies will very likely be complete by the end of 2004. At that time, 189 world currencies will be reduced to five. All of the currencies of Europe will be replaced by the Euro. All of the currencies of North, Central and South America will be replaced by the American dollar. All of the currencies of the African continent will be replaced by an as yet unnamed African monetary unit. All of the Pacific rim currencies will be replaced by a single Asian monetary unit. (The fight in Asia at this moment is whether the the monetary “base” of the new currency will be Chinese, Japanese or Korean.) And, finally all of the island nations in the South Pacific will be forced to accept a Southern Rim monetary unit based on the Australian pound. It is unclear whether a catastrophic major stock market and currency crash will be needed to accomplish the first phase of the globalization of the monetary systems of the world. It is not likely it will since the IMF and World Bank have been successful in intimidating second and third world nations who now understand that if they refuse to go along, they will [a] be cut off from foreign aid from the G-8 nations; [b] will not be eligible for any loans from the IMF or the World Bank, and [c] will find no market for their exports anywhere in the world. By 2006 or 2007, the regional currencies will be replaced by a single global monetary unit—virtual money or cybercash—that will exist only as a cyber unit in a universal computer database. It will require a major market crash and/or the collapse of the regional monetary systems to accomplish the final phase of globalization since the consumers not only in America but around the world will likely rebel against the notion of accepting virtual money in place of hard cash (even though the “hard cash” we use today has no more real value that the cybercash we will be using tomorrow since neither are asset-based. But, the idea of having cash in our pocket is so ingrained within us that most of us will not willingly accept Big Brother’s invisible money even if that money is available to us in the form of a “theft-proof” “smart card” ATM debit card.

Beginning of the Market

Slide

As the international

stock market started its up-and-down, topsy-turvy roller coaster ride

in 1998, the transnational industrialists who needed to create new consumers

in the second and third world nations in order to survive during the

21st century (since the industrialized nations have reached 99.999%

product saturation), have successfully manipulated the public image

of their corporations by making short term sales losses due to job transfers

from the United States to Mexico appear to be long term employment investments.

The market has grown for the past decade due entirely to the loose money policies of the Federal Reserve and the Central Banks of Europe. Historically, those who examine the phenomenal stock market growth of the 1920s can tie it to the loose money policy not only of the Fed but of investment bankers like J.P. Morgan and John D. Rockefeller, Jr. who poured $286 billion of private dollars into the market. In addition, the Fed expanded the money supply by 44%, up from $31.7 billion in 1921 to $45.7 billion in the summer of 1929. Interestingly, from 1999 until September, 2001 the Fed expanded the money supply by 28%—following the same pattern they used to “set up” both the economy and the stock market in 1929.

Over the past six months,

the market has issued several warnings that a major correction was imminent.

Few recognized the warning because the bellwether they had been accustomed

to watching failed to alert them. Gold. On May 18, 2001, gold spiked

at $13.80—an increase of 5%. Strangely, it happened three days

after the Fed cut its rate to 4%. Big money was jumping ship but they

didn’t want anyone to know it. Gold was quickly suppressed as the

large gold conglomerates dumped hundreds of pounds, driving the price

back down. There would be no bellwether warning because the investment

bankers were not ready to let the market slide.

As Alan Greenspan opened the floodgate to increase the money supply

to encourage spending, prices also began to rise because commodities

remain tied to the invisible gold benchmark. When money becomes too

elastic, prices rise. Commodities become more valuable as money becomes

too cheap. At the time, Bloomberg.com noted that “...the Fed has

lost sight of its long-term objective of price stability. Rising inflation

would be one thing if the raw material of inflation—money—was

signaling disinflation ahead. Instead, April [was] the fifth consecutive

month to see double-digit annualized increases in the broad monetary

aggregates, M2 and M3.”

Bloomberg was right—and wrong—at the same time. The Fed had lost sight of its long-term objective: price stability. But, it had two more important objectives: the regionalization of the currencies of the world and the transfer of a large segment of America’s job base to the under-employed nations in Central and South America who are expected to become the primary consumers of the 21st century—once their human capital is gainfully employed.

America has been losing from 14,000 to 18,000 jobs per month for the past three or four years as the industrial exodus stimulated by NAFTA got into full swing. These lost jobs means millions of dollars of consumer products could not be purchased by those former job holders; and that also means there are millions of dollars of taxes that are no longer being paid by those former taxpayers since they no longer have incomes which can be taxed.

As these former consumers stop buying goods, the industries which manufactured them suddenly discover at the end of their fiscal year that, instead of showing a profit, they are showing a loss. This is reflected when dividends the shareholders were expecting do not arrive; and the shareholders, who bought the stock specifically for the income the dividends provided, sells the stock. As more and more Fortune 1000 companies find their stock devalued due to declining consumer sales and rising debt, layoffs result as those companies attempt to conserve money. As those jobholders find themselves in the unemployment lines, even less consumer products are sold, resulting in an even more dismal picture for the stock market.

Breaking the Nest Eggs...and finding no yolk inside

In 1996 at age 61, Bruce Oradei, a former education consultant, decided to get out of the Washington, D.C. rat race and retired to his lakeside cottage in northern Wisconsin. During his “prime” years as a consultant, he had invested well in the stock market, and his nest egg was providing him with a comfortable income. In fact, Oradei was fortunate enough to retire with an income equal to that which he earned lobbying congress.

On September 11, within four hours of the terrorist attack on the World Trade Center, Oradei was on the telephone—job hunting. Beginning in May, 2001 Oradei considered doing what he was forced to do when the markets responded negatively to the terrorist attack on America; but he hoped that somehow the bull market would be rejuvenated and his nest egg would be protected.

In the early 1990s most of America’s companies who used brokerage companies to invest their corporate retirement programs in either blue chips or mutual funds, took a change of direction (one that would eliminate their liability if the markets headed south) and “allowed” the employees within the fund to “manage” their own retirement accounts. Millions of people nationwide who had no experience in buying or selling stock were suddenly cast into the role of day trader. If they traded well, they could retire with an above average income. If they did not trade well, they could lose not only the company’s portion of the retirement contribution, but their own as well. And, if they did, they had no legal recourse against anyone—except themselves.

Up until this spring, real estate broker Steve Jacobson planned to move in with a lady friend from Ocala, Florida he had been dating on and off for 25 years when he turned 65. In their thinking, they would have two Social Security checks supplemented by Jacobson’s stock investments which would allow them to live comfortably for the rest of their lives. Over the past two decades Jacobsons had invested heavily in both mutual funds and blue chip stocks. However, by May of this year—long before the terrorist attack on the World Trade Center which is now being blamed for the problems on the market—Jacobson’s portfolio had lost half of its value. Jacobson, like Oradei, never thought to pull any portion of their “profits” from paper and buy gold. Had they done so, the worst that would have happened to their portfolios is that they would not have lost that portion of their investment.

Over the past five to ten years, the financial prospects of those who were placing, and managing, their own retirement nest eggs in the stock market seemed to be relentlessly bright. The projected incomes of these pre-retirees were estimated at a growth rate that was at better than twice the rate of pre-retirees who did not control how their money was invested according to a survey done by AARP. (The results were, of course, based on investment gains in a bull market. If half of the years being studied had suffered through a bear market, it is likely that AARP would not have been quite so gung-ho on turning office workers, low level managers and clerks into day traders because not even experienced market traders fared well investing their own retirement nest egg.

Craig Longanecker, who was a senior investment specialist with Charles Schwab with 40 years of experience did fairly well during the good years of the bull market. He ran his portfolio up to a net worth of almost $3 million by last summer. A good portion of his portfolio was in high tech stocks—and still are.

He enjoyed planning his retirement last summer. He planned to devote much of his time to volunteer work. That and playing golf. He worked hard; but life had been good to him. He planned to give back to his community. That was before September 11. On that day, his portfolio lost 60% of its value. On September 10, after taking a beating all summer, Longanecker was worth about $3 million on paper. On September 11, he was worth $1.4 million. Today, he’s still worth seven digits, but his retirement income is evaporating before his eyes. Had Longanecker invested the $1.6 million he lost on September 11 in gold, he would have lost 60% of the $1.4 million he had left on September 11. But, his net worth on September 12 would have been $2,160,000.00 even if gold did not increase by $1.00 an ounce had he bought bullion on September 10. Had he bought the right numismatics (the investment of choice of the Rothschilds, which turned them into the wealthiest family in Europe), his portfolio would still have been worth $2,160,000.00 on September 12, but even if gold continued to be suppressed by the investment bankers, the price of numismatics are controlled by the law of supply and demand. Even when the spot price of gold is controlled by the investment bankers, numismatics escalate in value as the coins become more scarce.

In 1998, Rita Bregman sold some real estate that had been in her family. She netted $38 thousand. Rather than put the money in the bank and enjoy slowly spending it, Bregman invested it in high tech stocks like Microsoft, America Online, Yahoo and Cisco. Bregman was a lady who lived paycheck-to-paycheck most of her life. It appeared, by the spring of 2000 that she might be able to retire with an income that surpassed her monthly income during her working years. At age 59, Bregman was looking forward to retiring. She had co-authored a book of poetry with a friend and was now looking forward to visiting poets she had met on the Internet who lived in Europe. Eighteen months ago, Bregman’s $38 thousand investment had appreciated to $120 thousand. Had Bregman sold her investment after the surprise gold spike in May, 2000, and left her money in gold, the least her portfolio would be worth today would be $120 thousand since gold is sitting around its benchmark price. Instead, on September 11 Bregman’s $120 thousand portfolio (which cost her $38 thousand out-of-pocket dollars) was now worth $4,154.00. Depending how you look at it, she lost either $33,846.00 or she lost $115,846.00 in 24 hours.

Nobody could convince the day traders who were investing their retirement nest eggs in the stock market that the market was living on borrowed time. As far as they were concerned, the boom would continue forever. They were wrong. Our gold was going to Europe. From August, 1929 to March, 1933, almost $500 billion in gold coins and bullion was taken out of the United States by institutional investors in Europe. When the market crashed on October 29, 1929, only the middle class day traders were left in the market.

What happened on October 29, 1929 is going to happen again. Just as in 1929, when it happens again, it will not be an accident. The only question which remains unanswered is whether you will chose to be one of the victims or, with whatever you have left, one of the winners. Those who chose to ignore my advise last Fall, lost a lion’s share of their paper wealth in May of this year. They are already among the losers. The question is, what are they doing with the rest of those portfolios? Do you hang on, expecting the market to rebound? Or, do you take what you can and invest in gold? If you are investing your retirement nest egg, you have some tough choices. Glad I don’t have to make them for you because you can’t be a day trader in the gold market.

You need an expert...someone with a solid history of delivering phenomenal returns in numismatics.

I hope you find one before it's too late.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.