News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet Articles (2015)

Internet Articles (2014)

Internet

Articles (2013)

Internet Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

Editor's

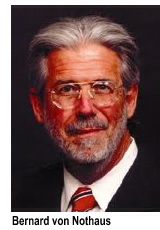

Note: I've known Bernard von NotHaus for maybe a decade,

and perhaps even longer. I've never been an advocate of the Liberty Dollar

since I believe the Constitution of the United States emphatically reserves

the right to "coin" the currency of the realm as an exclusive

franchise of its government. The printing of paper money, on the other

hand, is not a Constitutional prerogative only because when the Constitution

of the United States was penned, money was coinage. Scrip—paper money—was

a promise to pay real money when the crisis that triggered the issuance

of currency was over. Usually a war. Today that crisis is a government

that surrendered its right to coin the money of the realm to private bankers,

and now has a White House resident who appears determined to destroy its

monetary system. In the past, the problem with scrip was, if the side

of the conflict which issued the paper money lost, the scrip became worthless

and you lost your investment.

Today, the problem with scrip

is that it is too elastic and is only worth about 2% if what it was when

Woodrow Wilson surrendered the wealth of the nation to the interlocked

central banks of the world. The two—coins (always viewed as real

money) and currency (scrip) are at the heart of the Liberty Dollar tragedy.

That

said, I believe that when he is sentenced and surrendered to the US Marshals

for delivery to the federal penal system, Bernard von Nothaus will

come closer to the description of a political prisoner than any American

citizen ever incarcerated in the US penal system by the United

States government because Benard von Nothaus is the only non-elected

American citizen ever feared by the Federal Reserve.

That

said, I believe that when he is sentenced and surrendered to the US Marshals

for delivery to the federal penal system, Bernard von Nothaus will

come closer to the description of a political prisoner than any American

citizen ever incarcerated in the US penal system by the United

States government because Benard von Nothaus is the only non-elected

American citizen ever feared by the Federal Reserve.

he

Bernard von Nothaus trial began on March 8, 2011 in Statesville,

North Carolina. Sixty-seven year old von Nothaus was beginning

the final leg of an odyssey that began with the creation of the National

Organization for the Repeal of the Federal Reserve [NorFed] in 1998.

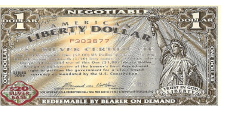

The first chapter of the Liberty Dollar saga came in 1999 when the Secret

Service launched its first investigation of NorFed. NorFed had just it

issued its first "paper currency," inappropriately called the

"Liberty Dollar" which, by its name, implied it intended to

be a rival currency to the US greenback. NorFed''s barter currency was

not challenged—then.

The investigative arm of the US Treasury investigated the Liberty Certificates

and decided that even though they were a thorn in Uncle Sam's side, the

barter currency NorFed peddled could not be construed as either a scam

or as counterfeit money since NorFed had sufficient silver on deposit

to redeem all of the certificates they issued.

he

Bernard von Nothaus trial began on March 8, 2011 in Statesville,

North Carolina. Sixty-seven year old von Nothaus was beginning

the final leg of an odyssey that began with the creation of the National

Organization for the Repeal of the Federal Reserve [NorFed] in 1998.

The first chapter of the Liberty Dollar saga came in 1999 when the Secret

Service launched its first investigation of NorFed. NorFed had just it

issued its first "paper currency," inappropriately called the

"Liberty Dollar" which, by its name, implied it intended to

be a rival currency to the US greenback. NorFed''s barter currency was

not challenged—then.

The investigative arm of the US Treasury investigated the Liberty Certificates

and decided that even though they were a thorn in Uncle Sam's side, the

barter currency NorFed peddled could not be construed as either a scam

or as counterfeit money since NorFed had sufficient silver on deposit

to redeem all of the certificates they issued.  The

certificates did not look like money. NorFed did not represent them as

money and, thus, the Justice Department did not believe they could pursue

a case against NorFed in which they could successfully argue that von

Nothaus construed his barter certificates to be "real" money.

The

certificates did not look like money. NorFed did not represent them as

money and, thus, the Justice Department did not believe they could pursue

a case against NorFed in which they could successfully argue that von

Nothaus construed his barter certificates to be "real" money.

That changed when von Nothaus began the mass coining of solid silver Liberty Dollars rather than printing NorFed certificates. Silver—solid silver—has an intrinsic value that not even the Fed's pre-1969 paper United States Silver Certificate denominations had. While the silver certificates were redeemable in silver on demand at a Federal Reserve Bank prior to that date, few people lived near one of the 12 Fed banks. Clearly, if you went to any State or federal bank and demanded silver coins for the paper bills from 1970 on, the coins you would get that used to be 90% silver now had a microscopically-thin layer of silver electroplated over a core that was 91.57% copper and 8.33% nickel. Exchanging pre-1969 Silver Certificates for pre-1970 silver coins was exchanging something of intrinsic value for something of intrinsic value. However, exchanging a post-1969 Federal Reserve dollar bill for post-1970 "silver" coins, you were exchanging fiat currency for fiat coinage. Neither had any intrinsic value other than what government decree said it was worth.

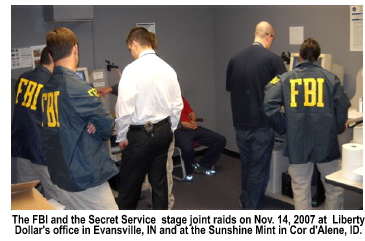

The final chapter of the

Liberty Dollar saga began on Wed., Nov. 14, 2007 when a dozen FBI and

Secret Service agents swept down on the Liberty Dollar's Evansville, Indiana

office at 225 N. Stockwell Road. At the same time another team of FBI

and Secret Service agents raided Sunshine Minting at 750 W. Canfield Avenue

in Coeur d'Alene, Idaho.  Between

the two locations, federal agents seized 16,000 pounds of gold and silver

coins and bullion and 3,039 lbs of Ron Paul copper coins. The precious

metals seized were estimated to be worth nearly $7 million in 2007 dollars.

The seizure is worth about $25 million in today's dollars.

Between

the two locations, federal agents seized 16,000 pounds of gold and silver

coins and bullion and 3,039 lbs of Ron Paul copper coins. The precious

metals seized were estimated to be worth nearly $7 million in 2007 dollars.

The seizure is worth about $25 million in today's dollars.

In addition to bullion and coins, the Secret Service seized all of the dies, molds and casts used to create the Liberties. All that was left in the building at the end of the day were empty desks and empty chairs. Everything else, every pencil, sheet of paper and paper clip, were seized.

Interestingly, the criminal indictment brought against von Nothaus only involved the coins his company manufactured and not the paper Liberty Dollars. However, since the silver that backed the Liberty Dollars has been seized, and will likely not be returned to those with mint receipts, they have no intrinsic value to collectors. The reason is an overstep by von Nothaus who sent a letter to the Justice Department telling them the seized silver and gold needed to be returned because it was the property of his mother, Mary vonNothouse. In mailings to Liberty Associates who purchased Liberty Certificates, von Nothaus advised them to write to the US Attorney's office and send them the warehouse receipt numbers of their certificates to verify their ownership claims to the silver. How can they claim to own the silver when von Nothaus told the US Attorney's office for the Western District of North Carolina that the bullion was owned by his mother?

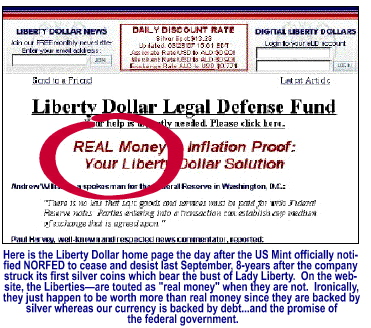

On September 14, 2006, the US Mint issued a public statement warning Americans that the Liberty Dollar is not legal tender and that the use of it as currency is a federal crime. On April 12, 2011 Coin World reported that the US Attorney's office in Charlotte, NC said that coin dealers and collectors may legally buy, sell and own all forms of Liberty Dollars as long as they don't attempt to circulate them as "current money." Slightly over 90 days after the US Mint's public statement, a federal court ordered the Liberty Dollar website taken down. On Jan. 1, 2007, the Liberty Dollar website, NorFed and Liberty Dollar ceased to exist. Yet, even with their assets seized, Liberty Dollar appears to have attempted to launch a cyberversion Liberty Dollar which makes no sense because it would be backed only by the faith of Liberty Dollar well-wishers that von Nothaus would prevail in the criminal indictment, and the Liberty Dollar would be reborn. That, clearly, didn't happen.

The spokesperson for the US Attorney said federal officials will not attempt to confiscate nor seek the prosecution of anyone who owns Liberty Dollars unless they violate the federal statutes for which von Nothaus was convicted, namely circulating the coins as "current money," or as von Nothaus did on his website (which the federal court ordered shut down and removed), calling his Liberty Dollars "real money."

In October, 2006 I received

a phone call from Bernard von Nothaus about a cease and desist

letter he received from the Dept. of Treasury warning him that charges

would be filed against him if he persisted in referring to his silver

medallions as "real money." In that conversation, as I sat looking

at his website, Bernard—who was attempting to raise money

not to defend himself against criminal charges which had not yet been

filed, but to sue the US Treasury for harassing him—insisted that

he never referred to his Liberties as "real money."  (See

directly below, left, the screenshot of his homepage, first reported on

BEHIND THE HEADLINES in 2006) in which he referred to his coins

as "real money.")

(See

directly below, left, the screenshot of his homepage, first reported on

BEHIND THE HEADLINES in 2006) in which he referred to his coins

as "real money.")

I directed Bernard to his own website. Then I also referred him to the US Code citations in the government's letter. The letter offered him a chance to extricate himself from what looked like something that was going to get legally ugly really quickly. The letter advised him to remove the cited language and threatening legal action if NorFed did not cease the practice of promoting what the Federal Reserve and the US Treasury said was an illegal currency.

Von Nothaus responded by hiring a lawyer and filing a lawsuit against the US Mint, Edmond C. Moy, the Director of the US Mint, Treasury Secretary Henry M. Paulson, Jr., and US Attorney General Alberto Gonzales, on March 20, 2007, in a move which likely elevated him to folk hero status in the eyes of the anti-Fed crowd.

The federal government argued from as early as 2006, and throughout the von Nothaus trial, that the self-described "monetary architect" deliberately attempted to create a counterfeit monetary system which could compete in the market place with the US dollar; and that, according to 18 USC § 486: "Whoever, except as authorized by law, makes or utters or passes, or attempts to pass, any coin of gold or silver or any other metal, or alloys of metal, intended for use as current money, whether in the resemblance of coins of the United States or foreign countries, or of original design, shall be fined under this title or imprisoned not more than five years, or both," is a federal crime since the right to create a monetary system in the United States of America is reserved, per Article I, Section 10 of the Constitution exclusively to its lawful government.

Sadly for Liberty Dollar,

von Nothaus and Liberty Associates who attempted to "spend the

Liberties into circulation," persisted in referring to the Liberty

Dollar, both paper and coin, as a private, non-government form of currency

until the end—even though Liberty Dollar had a disclaimer on its

own website since 2004 stating that the gold and silver Liberty coins

were neither "legal tender" nor "current money."  The

Liberty Dollar website made it clear that the coins did not resemble any

coinage minted, issued, authorized, or approved by any United States government

agency. After September, 2006, they began to refer to the Liberty Dollars

coins as "rounds" or "medallions," but they simply

couldn't escape calling it the "Liberty Dollar," or referring

to the medallions by their denominations (i.e., ten dollars, twenty dollars

or fifty dollars)—a monetary designation used by the United States

government. Thus the Liberty medallions were, through terminology recognized

by consumers as money, characterized as "dollars." According

to a statement on the website of the Charlotte, NC FBI website before

the trial began in Statesville, noted that von Nothaus, who for

years described himself as a "monetary architect," designed

the Liberty Dollar coins "...With the dollar sign ($), the word

"dollar"...Liberty, Trust in God (instead of 'In God We Trust'),

and other features associated with legitimate US coinage."

The

Liberty Dollar website made it clear that the coins did not resemble any

coinage minted, issued, authorized, or approved by any United States government

agency. After September, 2006, they began to refer to the Liberty Dollars

coins as "rounds" or "medallions," but they simply

couldn't escape calling it the "Liberty Dollar," or referring

to the medallions by their denominations (i.e., ten dollars, twenty dollars

or fifty dollars)—a monetary designation used by the United States

government. Thus the Liberty medallions were, through terminology recognized

by consumers as money, characterized as "dollars." According

to a statement on the website of the Charlotte, NC FBI website before

the trial began in Statesville, noted that von Nothaus, who for

years described himself as a "monetary architect," designed

the Liberty Dollar coins "...With the dollar sign ($), the word

"dollar"...Liberty, Trust in God (instead of 'In God We Trust'),

and other features associated with legitimate US coinage."

An incident happened at a Buffalo Sabres and New York Islanders hockey game at the HSBC Stadium on December 26, 2005 that would have serious ramifications on von Nothaus' fate. Derby, New York businessman Dan Buczek and seven family members were cheering the Sabres on to victory when Buczek's daughter, Amanda and her boyfriend, Joel Lattuca, went to the concession stand for refreshments. Amanda asked the concession stand attendant "...do you take Liberties?" and dropped a $20 silver coin into his outstretched palm. This, according to a US Mint spokesperson, is called "...the drop. NorFed," he said, "encourages its members to 'do the drop.' This means the Liberty Associate should drop one of its coins into the hand of the merchant so he can feel the weight of it, which is either solid silver or solid gold."

In the September, 2006 warning to the public about the Liberty Dollar, the US Mint said that "...Liberty merchants are encouraged to accept NorFed Liberty Dollar medallions and offer them in sales transactions or services. Further, NorFed tells Liberty Associates that they can earn money by obtaining NorFed Liberty Dollars at a discount and then can 'spend them into circulation.' Therefore, NorFed's Liberty Dollar medallions are specifically intended to be used as current money in order to limit reliance on, and to compete with, the circulating money of the United States. Consequently, prosecutors with the United States Department of Justice have concluded that the use of NorFed's Liberty Dollar medallions violate 18 USC § 486." The Buczek incident, fanned by the dislike of one of the Buczek offspring by a Buffalo police officer helped escalate the government's interest in branding von Nothaus as a "domestic terrorist," since his monetary principles were becoming contagious—as one after another "Liberty Associate" did the "drop" and convinced other Americans that they could barter with silver rather than trade in debt.

The vendor, however, who works for someone else, was not about to take the coin they offered simply because it wasn't something he recognized as money. Amanda Buczek paid for her order with a Federal Reserve Note. As Amanda and Joel returned to her family, they were followed by an off-duty Buffalo police detective, Ed Cotter. Cotter began to interrogate the family about what was reported to him as counterfeit coins, asking family members to produce ID—and the counterfeit money. In the end, Cotter arrested Dan Buczek and his son Shane. Amanda and Joel Lattuca who attempted to "spend" a $20 Liberty, and Buczek's youngest son, Caleb, were not detained. Click on this hyperlink for the whole story.

When the story went viral, a handful of Buffalo area Southtown business owners came forward to admit that they accepted Liberties as "legal tender." Shawn Clawges, owner of Opener' Grill in East Aurora, New York admitted he accepts Liberty coins "...at par with dollars. They're a pretty coin," he said, "and they are backed with silver. It's a commodity that's going up in value—unlike the US dollar."

Daniel Hyman, owner of the Red Apple Convenience Store said that "...about 20 of my regular customers use them. They pay me with silver and they accept silver as change. With inflation and government deficits, I see more and more people who don't trust paper money anymore. Eventually, I hope the banks will accept Liberties for deposit." This, of course, served to reinforce the fears of the US Treasury, the US Mint and the Federal Reserve that Liberty Dollars had been, and would continue to be increasingly successful in actually spending the Liberty Dollar into circulation. It's success, they feared, would be, in part, due to volatility of the dollar and George Soros' pledge to collapse the US monetary system as he collapsed the British pound in 1992. Soros protected his bet by backing Barack Hussein Obama—a man with a credentials so questionable that the man who promised the American people the most transparent government in history spent over a million dollars a year concealing every smidgen and iota of his past.

Couple the problems of a slowly fracturing global economy with the rapidly depreciating value of every currency in the world, plus China flexing its money muscle with Soros and Obama seemingly working in unison to collapse the US dollar, it becomes easier to see why the bankers were afraid that the timing was right for something like the Liberty Dollar—particularly if Soros had ever discovered von NotHaus.

With that thought in mind, it's no wonder that US Attorney Anne M. Tompkins felt prompted to justify the prosecution of Bernard von Nothaus by saying: "Attempts to undermine the legitimate currency of this country are simply a unique form of domestic terrorism. While these forms of anti-government activity do not involve violence, they are every bit as insidious, and represent a clear and present danger to the economic stability of this country. We are determined to meet these threats through infiltration, disruption, and dismantling of organizations which seek to challenge the legitimacy of our democratic form of government."

Following an eight day trial, Von Nothaus was found guilty on March 18 by a jury of his peers. They deliberated around 90 minutes before finding him guilty of [1] making silver, gold and copper coins resembling and/or similar to United States coins; [2] of issuing, passing, selling and possessing Liberty Dollar coins intended for use as current money, and [3] of conspiracy against the United States. Each charge carried a penalty of 5 years in a federal penitentiary and a $250 thousand fine. While US District Court Judge Richard Voorhees for the Western District of North Carolina has not passed sentence on von Nothaus, it is likely that von Nothaus will receive the maximum sentence specifically to deter others from attempting what von Nothaus did. Von Nothaus, who is now 67 years of age, will likely spend the rest of his natural life behind bars.

Still awaiting trial in May, 2011 was Liberty Dollar associates William Kevin Innes, 53, a Canadian national living in Asheville, NC who marketed Liberty Dollars in North Carolina. Innes was arrested and indicted a week or so before von Nothaus (who voluntarily surrendered to US Marshals in Fort Myers, Florida on Thus., June 3 2009). Von Nothaus bonded out, but Innes, who was viewed at a flight risk, has been incarcerated since his arrest in May, 2009. Sarah Bledsoe, the Liberty Dollar office manager and Rachelle Moseley, who managed the Liberty Dollar fulfillment office, were arrested by the FBI, taken into custody, arraigned and released on their own recognizance.

.

Copyright © 2011 •Jon Christian Ryter.

All rights reserved.