News

Behind the Headlines

Two-Cents Worth

Video of the Week

News Blurbs

Articles

Testimony

Bible Questions

Internet

Articles (2012)

Internet Articles (2011)

Internet Articles (2010)

Internet Articles

(2009)

Internet Articles (2008)

Internet Articles (2007)

Internet Articles (2006)

Internet Articles (2005)

Internet Articles (2004)

Internet Articles (2003)

Internet Articles (2002)

Internet Articles (2001)

China may outbid Chevron for California based Unocal. If China wins the the bid, will Walmart start selling Chinese gas, too?

China

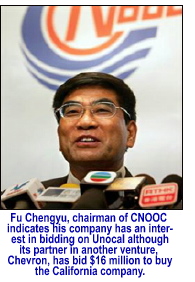

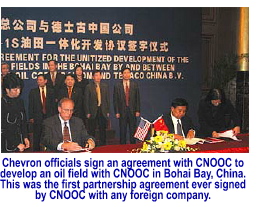

National Offshore Oil Corporation broke six months of silence over

whether or not it would attempt to take over the California-based oil

company, Unocal. CNOOC signaled last week that it is considering

upping Chevron's $16 billion bid in an attempt to gain a foothold

in the lucrative United States market.

China

National Offshore Oil Corporation broke six months of silence over

whether or not it would attempt to take over the California-based oil

company, Unocal. CNOOC signaled last week that it is considering

upping Chevron's $16 billion bid in an attempt to gain a foothold

in the lucrative United States market.

The unsolicited and unwanted bid by the Chinese government-owned CNOOC for an American oil asset will trigger political backlash which ever way it goes. First is the already strained relationship between the US State, Treasury and Commerce Departments over recent spats with China over trade and foreign exchange issues, plus new demands from the US State Department for claims of restitution that date back to the end of World War II when the communist regime seized the country and "nationalized" several American and British companies without compensating the shareholders of those companies for the assets the People's Republic of China seized.

The first clue

that CNOOC was contemplating making a bid for Unocal was

a statement the company made to the Hong Kong stock exchange last Tuesday

when it said it was "...continuing to examine its options with

respect to Unocal [with options]...that include a possible offer...for

Unocal," noting that no final decision had yet been made.

Clearly,

CNOOC was "testing the waters" to gauge the reaction

of the Bush Administration and the Securities & Exchange

Commission, the State of California and Unocal before floating

an offer. The reason we know CNOOC wants Unocal is that

Chinese officials are now pressuring non-executive directors in CNOOC

to make an offer. Independent directors have resisted making a bid that

would saddle CNOOC with billions of dollars of new debt. It was

this resistance that is rumored to have stopped a tentative bid in April,

just days before Chevron made its $16 billion offer for the company.

Clearly,

CNOOC was "testing the waters" to gauge the reaction

of the Bush Administration and the Securities & Exchange

Commission, the State of California and Unocal before floating

an offer. The reason we know CNOOC wants Unocal is that

Chinese officials are now pressuring non-executive directors in CNOOC

to make an offer. Independent directors have resisted making a bid that

would saddle CNOOC with billions of dollars of new debt. It was

this resistance that is rumored to have stopped a tentative bid in April,

just days before Chevron made its $16 billion offer for the company.

Since April,

the Chinese government has forced the ouster of at least one reluctant

non-executive board member. The remaining non-executive board members

have hired the Rothschild Investment Bank, Charles River Associates

consultant group and an American law firm, Skadden, Arps, Slate, Meagher

& Flom to advise them. Speculators and spectators alike see movement

in the Hong Kong market that suggests hedge funds are positioning themselves

for a piece of this anticipated action.  However,

knowledgeable insiders are convinced that as long as Unocal has

a viable offer on the table from Chevron it will be hard for CNOOC

to broker a deal of their own—even with Rothschild help. If

the handshake that seals the deal has taken place with Chevron—even

if no signatures have been exchanged—no amount of money offered by

CNOOC will break the Chevron purchase of Unocal. One

of the reasons CNOOC wants Unocal so bad (other than it

obviously wants to penetrate the American markets) is that the California-based

company has gas and oil reserves in Thailand, Indonesia and in central

Asia.

However,

knowledgeable insiders are convinced that as long as Unocal has

a viable offer on the table from Chevron it will be hard for CNOOC

to broker a deal of their own—even with Rothschild help. If

the handshake that seals the deal has taken place with Chevron—even

if no signatures have been exchanged—no amount of money offered by

CNOOC will break the Chevron purchase of Unocal. One

of the reasons CNOOC wants Unocal so bad (other than it

obviously wants to penetrate the American markets) is that the California-based

company has gas and oil reserves in Thailand, Indonesia and in central

Asia.

In the event CNOOC moves fast enough—and with enough money to outbid Chevron (which has Rockefeller money at its disposal)—the consumers in California need to boycott Unocal from the moment the transnational deal is finalized since what is owned by the Chinese government is, in reality, owned by the People's Liberation Army of the People's Republic of China. That means everytime Californians buy a gallon of gasoline at a CNOOC-Unocal station (providing CNOOC ends up with the company) they will be paying for a new clip of ammo for a Chinese AK47 that, some day in the not too distant future, will be firing at American troops_or American citizens. If CNOOC ends up with UNOCAL, consumers who buy their gas at Walmart™—thinking it's the one thing you can still buy at the chain Sam Walton built that doesn't come from China—need to ask themselves again just how many of their hard-earned dollars they want to send to the People's Liberation Army.

Once again, you have my two cents worth on this subject.

Copyright © 2009 Jon Christian Ryter.

All rights reserved.